WealthTech Robo Financial Planning Platform

It is one of a kind wealth management platform which has the sole purpose of helping the user understand his/her wealth portfolio from a holistic perspective before making investment decisions.

WealthTech Robo Financial Planning Platform

It is one of a kind wealth management platform which has the sole purpose of helping the user understand his/her wealth portfolio from a holistic perspective before making investment decisions.

WealthTech Robo Financial Planning Platform

It is one of a kind wealth management platform which has the sole purpose of helping the user understand his/her wealth portfolio from a holistic perspective before making investment decisions.

WealthTech Robo Financial Planning Platform

It is one of a kind wealth management platform which has the sole purpose of helping the user understand his/her wealth portfolio from a holistic perspective before making investment decisions.

WealthTech Robo Financial Planning Platform

It is one of a kind wealth management platform which has the sole purpose of helping the user understand his/her wealth portfolio from a holistic perspective before making investment decisions.

Platform Features

A Plug-N-Play Financial Planning Platform for your Customers

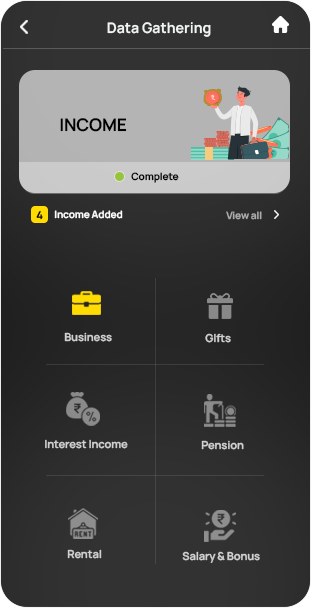

Money Management Analysis

Detailed Income and Expenses Analysis and advisory for Expenses optimization is provided in the form of categorized envelopes

Goal analysis and Asset mapping

The Goal Analysis and Mapping engine has powerful algorithms which provide in-depth individual goal analysis and auto linkage with right assets.

Portfolio analysis and Asset allocation Rebalancing

In-depth understanding of the existing portfolio and an actionable report about recommendations to rebalance.

Advice on Goals

Inflow and outflow optimization helps keep the purse strings tight since it is clear in the cash flow table

Retirement planning and analysis

Detailed pre-retirement and post-retirement cash flow based on the current standing. Gives the answer to the golden question “In which year can I retire comfortably?”

Personalized Recommendation

A complete analysis of a given user's income, expenses, assets, liabilities and goals can generate customized actionable advice

Risk Appetite Assessment

Actionable insights in terms of investment strategy to complete the entire cycle right from risk appetite assessment to final investment recommendations.

Platform Process flow

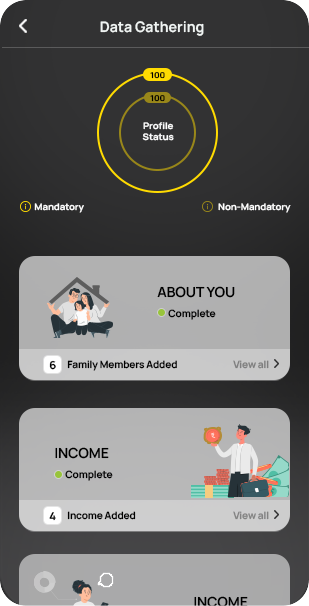

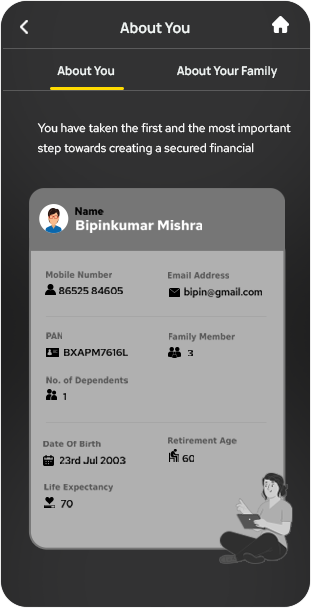

Profile Creation

User details obtained at a high level to avoid input fatigue.

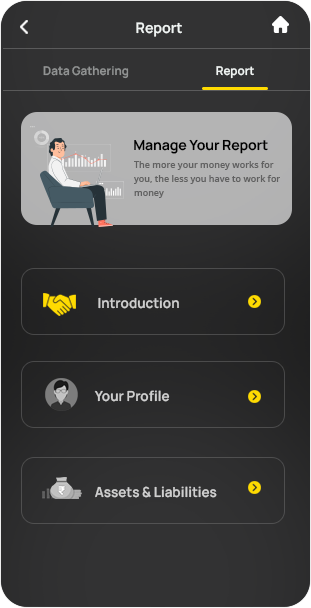

Financial Planning Report

Generate a tangible and actionable roadmap based on the user's profile.

Plan Of Action

Offer specific recommendations on asset allocation, investment products, and strategies to implement the financial plan.

Secure a meeting